06.04.2020 Preventive measures taken by the Directorate General of Customs (DGA) in response to the COVID-19 pandemic The Directorate General of Customs (DGA), in the context of the emergency situation due to the COVID-19 pandemic and seeking to collaborate in response to the impact that this represents, adopts the following measures: Exemption of the surcharge for late declaration (Art. 52 of Law No. 3489), upon a request submitted to the Customs administration, which will coordinate its implementation. For the computation of the term of storage of the merchandise in the Bonded Warehouse Regime, under any of its modalities: fiscal, re-export and cargo consolidation, the days from Friday 20 March 2020 until three (3) business days after the lifting of the national emergency estate, will not be taken into consideration. The Customs administration will deduct the days of quarantine from the terms to be computed so that a merchandise is not considered in fact abandonment. For digital signature procedures, support will be provided through the e-mail addressfirmasdigitalesti@aduanas.gob.do and by phone. Since 24 March, the files of the following requests are received only by e-mail (info.correspondenciayarchivo@aduanas.gob.do): Application of Tax Payment Exemption Law 253-12 Request for Exemption from Payment of Taxes According to Provision no. 7204 WTO Contingent Authorization (Technical Rectification)

The cash registers hours in Customs offices will be until 3:00 p.m. starting 24 March and users are invited to make payments electronically. Theregistrationofnewimportersand/orexporters,fortheinclusionofagentsandfor authorization of intermediaries, can be requested electronically from 23 March, after the completion of the requirements established by the DGA. Details areavailable in the institutional webpage www.aduanas.gob.do in the Services tab, General option. These requests should be summited by e-mail (unidadregistro@aduanas.gob.do). The new containers release schedule in Customs offices will be until 5:00 p.m., attending to the curfew imposed by the Executive Branch. During the emergency situation, the collection of all import taxes is temporarily suspended on the following goods: masks, clothing, protective equipment and medical instruments, machines or devices necessary to combat the COVID-19 pandemic, which will apply via the Integrated Customs Management System (SIGA).

With this temporary suspension of taxes, the entire bureaucratic process is avoided to obtain a formal exemption, which, if required, could be carried out afterwards. This suspension of taxes includes, specifically, the Customs tariff where applicable, and the Tax on the Transfer of Industrialized Goods and Services (ITBIS or VAT). The materials and equipment to apply 0% tariff and ITBIS are the following:

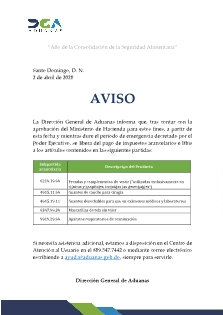

Subheading | Product Description | 6210.10.00 | Garment and garment accessories ("used exclusively in clinics and hospitals, including disposables") | 4015.11.00 | Rubber gloves for surgical use | 4015.19.11 | Disposable gloves for medical and laboratory use | 6307.90.30 | Non-woven fabric face masks | 9019.20.00 | Respiration apparatus for resuscitation |

Measures taken for Trade Facilitation on the COVID-19 pandemic: Single Window for Foreign Trade (VUCE): VUCE operations continue their normal course and only the assistance for the measures in response to COVID-19 is now remotely.

The institutions are accepting copies of the phytosanitary and zoo-sanitary certificates and their revision is through the system. Different channels have been set up to coordinate the closure of VUCE authorizations allowing importers and exporters to schedule inspections (if necessary) and monitor the authorization process in the port.

In case of requiring assistance, users can communicate by phone at 809-547-7070, ext. 2662 and 2663 or through the email gestiónyprocesosvuce@aduanas.gob.do and trough the site www.vucerd.gob.do.

Further information : http://www.wcoomd.org/-/media/wco/public/global/pdf/.... |