Source: South African Goverment / www.gov.za

17.09.2020

Travel - Coronavirus COVID-19

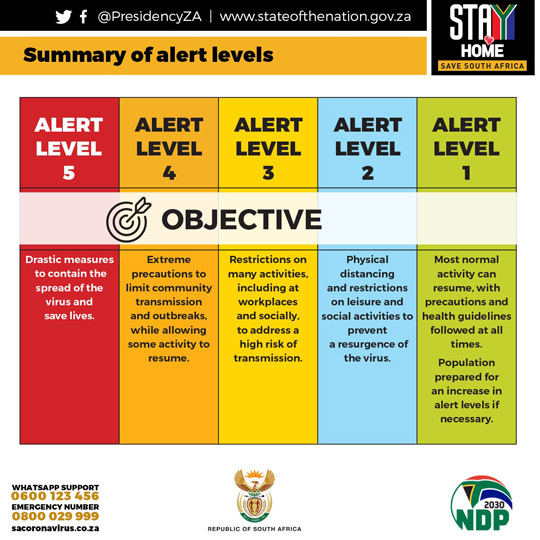

The five-level COVID-19 alert system has been introduced to manage the gradual easing of the lockdown.

This risk-adjusted approach is guided by several criteria, including the level of infections and rate of transmission, the capacity of health facilities, the extent of the implementation of public health interventions and the economic and social impact of continued restrictions.

The country will be on alert level 2 from 00h01 on 18 August 2020.

The country was on alert level 3 from 1 June to 17 August 2020.

The country was on alert level 4 from 1 to 31 May 2020.

The country went into lockdown from midnight 26 March to 30 April 2020. (Alert level 5)

Criteria for determination of alert levels

Alert levels determine the level of restrictions to be applied during the national state of disaster.

(a) 'Alert Level 1' indicates a low Covid-19 spread with a high health system readiness;

(b) 'Alert Level 2' indicates a moderate Covid-19 spread with a high health system readiness;

(c) 'Alert Level 3' indicates a moderate Covid-19 spread with a moderate health system readiness;

(d) 'Alert Level 4' indicates a moderate to a high Covid-19 spread with a low to moderate health system readiness;

(e) 'Alert Level 5' indicates a high Covid-19 spread with a low health system readiness.

The Ministerial Advisory Committee must advise the Minister of Health regarding which Alert Level should be declared nationally, provincially, in a metropolitan area, or a district, when taking into account

(a) the epidemiological trends of Covid-19 infections;

(b) the health system capacity in a specified area to respond to the disease burden; and

(c) any other factor that would influence the level of infection, hospitalisation and mortality.

Epidemiological trends includes a consideration of the trends in the number of tests done, number of persons screened, number of positive cases, number of recoveries and the demographic profile of the positive cases.

Health system capacity includes a consideration of the number of facilities available to support Covid-19, bed-occupancy levels for the various levels of care, human resource capacity, equipment and related resources.

(Gazette 43599, 7 August 2020)

Alert levels summary

Related information:

Coronavirus / COVID-19

Alert level 2

Alert level 3

Alert level 4

Alert level 5

Source : https://www.gov.za/covid-19/individuals-and-households/travel-coronavirus-covid-19

Source: South African Revenue Service (SARS)

17.09.2020

SARS’s Customs division plays an integral role in facilitating the movement of goods and people entering or exiting the borders of the Republic.

The Excise division facilitates the levying of duties on certain locally manufactured goods as well as on their imported equivalents.

During the lockdown period, for any escalations pertaining to a specific Customs branch or to make a branch appointment, see the Customs Branch contact details. If you need to escalate beyond branch offices, please email osc@sars.gov.za.

Updates on Customs branch, ports, borders etc. closures:

- 11 September: Skilpadshek border post (Botswana) has reopened.

- 10 September: Skilpadshek (Botswana) is closed until further notice.

- 23 August: Skilpadshek border post (Botswana) has reopened.

- 22 August: Skilpadshek border post (Botswana) has closed.

- 20 August: Albany House in Durban will be closed as from 09h30 today and will reopen tomorrow, 21 August.

- 17 August: Polokwane International Airport will be closed today.

- 14 August: Groblers Bridge border post (Botswana) will be closed and will reopen on 15 August.

- 7 August: Ficksburg border post (Lesotho) has been reopened.

- 6 August: The Maseru Bridge border post (Lesotho) has been reopened.

- 6 August: Groblers Bridge border post (Botswana) will be closed from 12:00 to 15:00 today.

- 6 August: The Maseru Bridge border post (Lesotho) is closed until further notice.

- 5 August: Ficksburg border post (Lesotho) will be closed from 10:00 tomorrow until Friday 7 August.

- 3 August: Beitbridge border post (Zimbabwe) will be closed from 14:00 to 20:00 today.

- 2 August: Richards Bay office closed until further notice.

- 1 August: Jeppes Reef border post (Swaziland) has been reopened.

- 31 July: Oshoek border post (Swaziland) has been reopened.

- 31 July: Jeppes Reef border post (Swaziland) closed until further notice.

- 31 July: Skilpadshek border post (Botswana) has been reopened.

- 31 July: Customs Albany House (Durban) has been reopened.

- 30 July: Oshoek border post (Swaziland) closed until further notice

- 29 July: Skilpadshek border post (Botswana) closed until further notice.

- 29 July: Customs Albany House (Durban) closed until further notice.

- 29 July: Golela border post (Swaziland) will reopen at 16:00 this evening.

- 28 July: Nakop border post (Northern Cape) has been reopened

- 26 July: Nakop border post (Northern Cape) closed until further notice

- 25 July: Vioolsdrift border post (Namibia) has been reopened

- 25 July: Mahamba border post (Swaziland) has been reopened

- 24 July: Mahamba border post (Swaziland) closed until further notice

- 24 July: Vioolsdrift border post (Namibia) closed until further notice

- 22 July: Van Rooyenshek border post (Lesotho) has been reopened

- 18 July: Groblersbridge Port is closing this evening at 19:00 and reopening 19 July at 06:00 in the morning

- 18 July: Oshoek border post (Swaziland) has been reopened

- 18 July: Kopfontein border post (Botswana) has been reopened

- 17 July 2020 - Customs Albany House in Durban has reopened

- 16 July 2020 - Lebombo border post has reopened

Updates on Customs news

4 September 2020 - Escalation procedures for Customs matters

Contact details for service-related queries in Gauteng13 July 2020 - National classification list of COVID-19 medical supplies

30 June 2020 - Escalation procedures for Customs matters

25 June 2020 - ITAC Amended Guidelines for Rebate Item 412.11(a)

Please take note of the draft amended guidelines for paragraph (a) of rebate item 412.11/00.00/01.00 published by ITAC for comment.

Due date for comment: 29 June 2020

Please forward comments electronically to the following official, using

"Amended Guidelines for Rebate Items 412.11(a)" in the Subject line of the e-mail:

Alexander Amrein

Senior Manager: Policy and Research

E-mail: aamrein@itac.org.za

12 June 2020 – Rule amendment notice R670 in GG 43435 under sections 19A, 54AA, 105 and 120

Relief measures under the Customs and Excise Act, 1964 to assist in alleviating the negative effects of the COVID-19 pandemic in the Customs and Excise sphere, including – DAR197- insertion of rule 19A.11 concerning deferral of certain excise duty payments;

- amendment of rules 54FD.04 and 54FD.05 concerning deferral of first carbon tax submissions and payments; and

- insertion of rules 105.01 to 105.04 concerning instalment payment

The effective date of the rule amendments is 12 June 2020, except for rule 19A.11, which commences retrospectively on 1 May 2020.

- 4 June 2020 – Notice of Expiration of VAT Certificate issued in terms of Schedule 1(8) of the Value-Added Tax Act, 89 of 1991, Item 412.11/00.00/01.00

This notice serves to advise interested parties that the global Value-Added Tax (VAT) Certificate issued by the International Trade Administration Commission of South Africa (ITAC) on 8 April 2020 under Schedule 1(8) of the Value-Added Tax Act, 89 of 1991, Item No. 412.11/00.00/01.00 (Rebate Item 412.11) will expire at midnight on Friday, 5 June 2020. - 29 May 2020 - ITAC reminder on rebate certificates' expiry date

ITAC has published a reminder that rebate certificates issued under Rebate Item 412.11/00.00/01.00 will expire on 31 May 2020. - 20 May 2020 – Second Draft Disaster Management Tax Relief and Relief Administration Bill

National Treasury and SARS publish the 2nd revised 2020 Draft Disaster Management Tax Relief Bill and revised Draft Notice on Expanding Access to Living Annuity Funds. These are published to provide early feedback on issues raised through public comment on the revised COVID-19 Draft Tax Bills published on 1 May 2020 that are time critical for payroll and other aspects to be implemented in May 2020.

The 3rd revised 2020 Draft Disaster Management Tax Relief Bill and 2020 Draft Disaster Management Tax Relief Administration Bill, as well as the Notice on Expanding Access to Living Annuity Funds, will be published by the end of May to take into account all public comments received on the revised COVID-19 Draft Tax Bills published on 1 May 2020. They provide the necessary legislative amendments required to implement the tax measures to combat the COVID-19 pandemic.- Media Statement: Publication of the 2nd revised COVID-19 Draft Tax Bill and extension of time for public comments on specific 2020 tax proposals

- Draft Disaster Management Tax Relief Bill – 19 May 2020

- Draft Explanatory Memorandum on the Revised Draft Disaster Management Tax Relief Bill – 19 May 2020

- Notices – Expanding access to living annuities – 19 May 2020

- 12 May 2020 – Reporting of Conveyances and Goods - External Policy

The Reporting of Conveyances and Goods policy has been updated to clarify that exemptions granted in respect of cargo reports apply to advance container loading notices, advance cargo arrival notices (imports), departure reports (exports) as well as acquitted manifests. - 8 May 2020 – ITAC VAT Rebate 412.11 List of CRITICAL MEDICAL SUPPLIES re COVID-19 (Version 3 - 6 May 2020)

The revised list includes a revised classification of plastic face shields from 3926.20 to 3926.90. - 8 May 2020 – Update on 412.11 and 621.08

- 7 May 2020 – Request for Duty Payment Relief

- 6 May 2020 – SARS VAT 412.11 Mapping of ESSENTIAL GOODS re COVID-19 - 6 May 2020

As published on 3 April 2020, the SARS VAT Rebate 412.11 provides a mapping of essential goods with reference to Annexure B of the Regulations (R.398, Government Gazette No. 43148 of 25 March 2020) under the Disaster Management Act, 2002.

The revised list includes plastic face shields. - 4 May 2020 – Publication of Notice, Regulation and ITAC VAT Rebate Item 412.11 Updated list of CRITICAL MEDICAL SUPPLIES

- Notice 487 in Government Gazette No. 43266 of 4 May 2020: Direction by the Minister of Finance in terms of the Regulations (R.480 in Government Gazette No. 43258 of 29 April 2020) issued by the Minister of Cooperative Governance and Traditional Affairs – section 27(2) of the Disaster Management Act, 2002, relating to essential financial services

- Regulation R.480 in Government Gazette No. 43258 of 29 April 2020

- ITAC VAT Rebate 412.11 CRITICAL MEDICAL SUPPLIES re COVID-19 (Version 2 - 4 May 2020) to include Acetaminophenol (bottom of first page), classifiable in tariff subheading 2924.29.05, for use in the manufacture of medicaments

- 1 May 2020 – Revised COVID-19 Draft Tax Bills and Draft rule amendments

- Media statement – Publication of the revised COVID-19 Draft Tax Bills for public comment

- Revised Draft Bill – Disaster Management Tax Relief Bill, 2020

- Revised Draft Bill – Disaster Management Tax Relief Administration Bill, 2020

- Draft Explanatory Memorandum on the Revised Draft Disaster Management Tax Relief Bill

- Draft rule amendments under Customs and Excise Act 1964 – COVID-19 Relief Measures

National Treasury and the South African Revenue Service (SARS) publish, for public comment, the revised 2020 Draft Disaster Management Tax Relief Bill and 2020 Draft Disaster Management Tax Relief Administration Bill. These Bills give effect to the media statement issued by National Treasury on 24 April 2020 regarding further tax measures to combat the COVID-19 pandemic, following the address by President Cyril Ramaphosa on 21 April 2020.

The revised 2020 Draft Disaster Management Tax Relief Bill and the 2020 Draft Disaster Management Tax Relief Administration Bill provide the necessary legislative amendments required to implement the further tax measures aimed at combating the COVID-19 pandemic and also take into account public comments received on the initial batch of COVID-19 draft tax bills published on 1 April 2020.

Public comment to be submitted by 15 May 2020 to 2020AnnexCProp@treasury.gov.za and Adele Collins at acollins@sars.gov.za.

- 24 April 2020 - Update to the 9 April post of what other countries are doing during the COVID 19 Pandemic (Eswatini and Lesotho)

- 22 April 2020 - Frequently Asked Questions (FAQs) relating to essential goods, clearance and movement of goods, and services rendered by Customs under the COVID-19 lockdown

19 April 2020 - Update: Customs measures relating to COVID-19 - Impact on Customs of new Government regulations

This replaces the notes of 6 and 7 April relating to Transportation of Cargo.

17 April 2020 - Requests for duty deferment payment relief

17 April 2020 - Updated Letter to Trade: Update on the new Registration, Licensing and Accreditation (RLA) system

14 April 2020 - Application of Origin proof requirement during the COVID-19 crisis under the SADC-EU-EPA

South Africa and the European Commission has relaxed the requirement to insist on the presentation or submission of original certificates of origin to prove the originating status of goods at the time of clearance. Instead, copies or electronic versions of proof of origin will be accepted in an attempt to curb the spread of the COVID-19. In South Africa, the relaxation of the rules is subject to the submission of the original certificates within 12 months after being issued in the European Union (EU). While Article 26 to Protocol I of the SADC-EU Economic Partnership Agreement (EPA) requires the submission of an original proof of origin within ten (10) months, SARS will honour or accept copies or electronic versions of certificates of origin while awaiting the submission of the original versions within twelve (12) months after being issued in the EU.

Traders are encouraged to register for the generous Approved Exporter Scheme, within the meaning of Article 25 to Protocol I of the SADC-EU EPA, which allows an Origin Declaration to be presented in the importing country no longer than two (2) years after the importation of the products to which it relates. Kindly direct all enquiries in relation to this matter to Mr Alfred Ramoroka at aramoroka@sars.gov.za.- 9 April 2020 – Goods qualifying for import VAT exemption under item 412.11 – COVID-19 measures (Updated the 3 April message on 9 April 2020 to reflect additional exclusion communicated by ITAC, with effect from 8 April 2020)

SARS wishes to clarify that "essential goods" as defined in Regulation R.398 in Government Gazette No 43148 of 25 March 2020, other than the goods mentioned below, are exempt from VAT on importation under item 412.11/00.00/01.00 to Schedule 1 of the Value-Added Tax Act, 1991, read with section 13(3) of that Act.

Goods that are not exempt from VAT on importation are goods that the International Trade Administration Commission (ITAC) has indicated are:1) dutiable (and no ITAC certificate under item 412.11 of Schedule No. 4 of the Customs and Excise Act, 1964, has been issued);

2) subject to the duties referred to in 1) but are entering South Africa duty free because of a preferential trade agreement or other agreement, such as a customs union;

3) the subject of applications for duty support that are currently pending before ITAC; and

4) manufactured by domestic industry and ITAC has determined such industry is being or is likely to be injured by imports.

See the illustrative mapping of essential goods to their relevant tariff headings. The illustrative mapping has been prepared at a high level and may include non-essential goods. e.g. Chapters 28 and 29 contain chemicals that are not used for essential goods. Importers must ensure that only essential goods are cleared under item 412.11 to avoid penalties.

Goods excluded from the import VAT exemption under 1) are those goods that are subject to an ordinary customs duty, as set out in Schedule No. 1, or trade remedies (anti-dumping, countervailing or safeguard duty), as set out in Schedule No. 2 to the Customs and Excise Act, 1964. Goods excluded under 2) are also set out in these Schedules. A list of goods excluded under 3) and 4) is available in the relevant ITAC certificate. Click here for the ITAC import VAT certificate dated 30 March 2020. Click here for the ITAC import VAT certificate dated 8 April 2020.

Goods that qualify for VAT exemption and are not dutiable fall under the certificate issued by ITAC in this regard and no individual applications need be submitted to SARS or ITAC.

Importation will follow the normal procedure described in the external policy SC-CF-55 – Clearance declaration external policy. The VAT exemption is only valid for direct importations and not to be cleared into bond or warehousing. CPC A 14 must be used for importations from outside SACU and CPC A 12 for importations from the BLNS, with measure 412.11/00.00/01.00.

During the COVID-19 pandemic, SARS Customs has also set up a command centre to deal with escalations that may have not been dealt with at branch level. Your existing call reference number, transaction (SSM/LRN) can then be sent to osc@sars.gov.za. To save duplication and time, clients are reminded that queries must be sent to the relevant branch/processing centre.

Please note that the VAT treatment of the local supply of goods by an importer or any other vendor is unaffected by the import VAT exemption. The normal provisions of the Value-Added Tax Act, 1991, apply. 9 April 2020 - SADC Guidelines on Harmonisation and Facilitation of Cross Border Transport Operations across the Region During the COVID-19 Pandemic (Updated on 15 April with neighbouring countries details)

Domestic, interstate and international travel have proven to be one of the main ways the COVID-19 virus is spreading among communities, nations and globally. There is therefore a need to limit travelling and freight movements to the absolutely essential only.

9 April 2020 - Notice No. R.458 in Government Gazette No. 43222

Rule amendment to substitute Rule 24.03 to provide for the exemption of foreign-going ships or aircraft from the payment of duty on stores consumed on such ships in any port in the Republic, or on an aircraft on a flight between any places in the Republic for the duration of the national state of disaster. With retrospective effect from 23 March 2020.3 April 2020 – Goods qualifying for a full rebate of customs duty and import VAT exemption under 412.11 – COVID-19 measures

Importation of supplies critical to the national state of disaster necessitated by the COVID-19 pandemic can be done free of duty and VAT into South Africa.

Importers are required to apply to ITAC for a certificate to use that qualifies them to import under rebate item 412.11.

Qualifying products referred to as “critical supplies” are listed on the ITAC website, as is the application form and the SOP.

The importation of these goods will follow the normal Customs procedure described in the external policy SC-CF-55. The rebate item is only valid for direct importations and no bonded or warehouse clearances will be permitted under this rebate item. CPC A 14 must be used for importations from outside SACU and CPC A 12 for importations from the BLNS, with measure 412.11/00.00/01.00.

If requested to provide supporting documents to Customs, the client would need to upload the certificate issued to the importer by ITAC, along with the standard set of supporting documents to substantiate the import declaration.

During the COVID-19 pandemic, SARS Customs has also set up a command centre to deal with escalations that may have not been dealt with at branch level. Your existing call reference number, transaction (SSM/LRN) can then be sent to osc@sars.gov.za. To save duplication and time, clients are reminded that queries must be sent to the relevant branch/processing centre.

3 April 2020 – Treatment of timeframes during period of national lockdown

Please Note that the Disaster Management Tax Relief Administration Bill, 2020 has been published on the SARS website for public comment. The closing date for comments is 15 April 2020. In terms of proposed clause 5(2)(a)(i) of the Bill, certain time periods prescribed in terms of the Customs and Excise Act, 1964, are suspended for the duration of the national lockdown as defined in clause 1 of the Bill. The time periods that are not extended during the national lockdown are dealt with in clause 5(2)(a)(ii). In respect of these time periods, the current provisions of the Customs and Excise Act, 1964, will apply. Current provisions in terms of the Customs and Excise Act in relation to interest and penalties will continue to apply in respect of non-compliance.

2 April 2020 – COVID-19 Export Control Regulation

SARS has been requested by the Department of Trade and Industry to add the listed goods to its prohibited and restricted list (P&R list) for purposes of export control. It is not a ban. Traders may apply to the International Trade Administration Commission (ITAC) for an export permit, and if granted the goods may be exported. See the Notice R.424 for more information.2 April 2020 – Processing of Rules of Origin certificates during lockdown

Customs clients submitting Certificates of origin, including: Form A, EUR1, SADC, MERCOSUR and AGOA, will continue to do so at their local branch as per communique dated 26 March 2020 (using an appointment process). However, clients in Durban and Cape Town are advised that Certificates of origin will only be processed during the lockdown period on the following days: Monday, Wednesday and Friday. A skeleton staff complement will be deployed to these two Customs hubs to assist on the abovementioned days for limited hours. Please note that receipt and collection of the certificates is to be done between 08:00 and 12:00 on those three days only.

The hubs are situated at:Durban: Albany House

61/62 Margaret Mncadi aveCape Town: SARS Project 166

22 Hans Strydom Avenue1 April 2020 – Draft Disaster Management Tax Relief and Relief Administration Bill

Following the media statement issued by the Minister of Finance on 29 March 2020 on Tax Measures to Combat the COVID-19 pandemic, the National Treasury and the South African Revenue Service (SARS) today publish, for public comment, the 2020 Draft Disaster Management Tax Relief Bill and the 2020 Draft Disaster Management Tax Relief Administration Bill. These draft Bills provide the necessary legislative amendments required to implement the COVID-19 tax measures. The measures contained in these draft Bills will take effect on 1 April 2020:- Media Statement: Publication of COVID-19 Draft Tax Bills for public comment

- Draft Disaster Management Tax Relief Bill – 1 April 2020

- Draft Disaster Management Tax Relief Administration Bill – 1 April 2020

- Draft Explanatory Memorandum on the Draft Disaster Management Tax Relief Bill – 1 April 2020

27 March 2020 – Clarity relating to processing of cargo and travellers during national lockdown period

27 March 2020 – VAT exemption for essential goods on importation (29 March – Updated to reflect scope of customs duty rebate and 3 April – Updated with contact details)

Due to the measures put in place under the Disaster Management Act 57 of 2002, “essential goods” as defined in Regulation R.398 in Government Gazette No. 43148 of 25 March 2020 will be subject to a VAT exemption on importation during the COVID-19 pandemic, under Item 412.11/00.00/01.00 of Schedule 1 to the Value Added Tax Act 89 of 1991. A full rebate of customs duty under rebate item 412.11 of Schedule No. 4 to the Customs and Excise Act 91 of 1964 is available where ITAC has approved the rebate for the goods concerned.- Visit the ITAC website for information relating to the full rebate of customs duty under Covid-19 Rebate Item 412.11

- Queries specific to classification may be addressed to Selloane Molebatsi at SMolebatsi3@sars.gov.za and Lmadileng@sars.gov.za.

26 March 2020 – Timeframe for the export of goods by vendors and qualifying purchasers affected by COVID-19

26 March 2020 – Rebate Item 621.08 – Special conditions for certain recipients of partially or undenatured ethyl alcohol

26 March 2020 – Arrangements for Customs services during lockdown and Customs Branch Managers contact details

25 March 2020 – Letter to Trade on the impact of COVID-19

25 March 2020 – 12-13th Deferments Payment at the end of the financial year 2019/2020

20 March 2020 – Registration of Cargo reporter

This week SARS announced that it is taking measures to ensure the safety of its staff and clients, including encouraging social distancing and limiting the number of people visiting SARS offices. As a result, if Customs clients wish to register as a cargo reporter, instead of couriering their registration documents or handing them in at SARS head office in Pretoria, they are asked to scan them and mail them to NLegodi@sars.gov.za.

For queries, you can call 012-422 8388.

17 March 2020 – Letter to Trade – Impact of Corona virus on Trade and the list of closed ports.

12 March 2020 – Update on Registration, Licensing and Accreditation (RLA)

4 March 2020 – The new Registration, Licensing and Accreditation (RLA) system will go live on eFiling and in Customs branches from 20 April 2020. Watch this space for more information.

Source: https://www.sars.gov.za/ClientSegments/Customs-Excise/Pages/default.aspx

Source: IMPACCT/ UN OCHA

29.07.2020

COVID-19 [South Africa] Bulletin n°1 – CIQP : 29 July 2020 (Customs, Immigration and Quarantine Procedures)

IMPORTATION AND CUSTOMS / IMPORTATION ET DOUANES

Customs, land, sea

Sea ports:

Vessels arriving from international ports are not allowed to enter any seaports in South Africa

unless it has been communicated to Port Health prior to arrival. Ports are operational, but

working with a reduced workforce and berths.

All vessels that have undertaken an international voyage must apply for Free Pratique to Port

Health 24-48 hours prior to arriving at port.

A declaration of any crew who joined the vessel from any high or medium risk country and the

transit points they went through and stowaways is required.

All passenger vessels are prohibited from disembarking any passengers or crew at any of South

African sea ports.

No crew change allowed except for crew change for South African seafarers and evacuation.

Masters, Seafarers and Ship Operators are to ensure that each individual seafarer, wishing to

join or sign off a vessel completes a Crew Health Self-Declaration & Daily Temperature Records.

Masters, Seafarers and Ship Operators are to ensure that each individual seafarer, wishing to

join or sign off a vessel completes a Crew Health Self-Declaration & Daily Temperature Records.

Evacuation of seafarers and passengers on board all ships along the South African coastline will

be allowed in terms of Search and Rescue as well as the Merchant Shipping Act, 1957 (Act No.

57 of 1957) and subject to the following: (i) The evacuation must comply with the provisions of

Medical Evacuations as contained in the South African Maritime and Aeronautical Search and

Rescue Act, 2002 (Act No. 44 of 2002) ; (ii) The evacuation to be carried out in terms of the

approved Standard Operating Procedures for evacuation as contained in the Maritime Rescue

Coordination Center Manual obtainable from the South African Maritime Safety Authority

website; and (iii) All evacuated patients will be subjected to mandatory quarantine for a period

of up to 21 days.

All other cargo vessels will be allowed into all the sea ports for purposes of cargo works,

replenishing fuel and provisions.

The following sea ports are open for purposes of handling cargo, refuelling and ship supplies:

Richards Bay; Durban; East London; Coega; Port Elizabeth; Mosselbay; Cape Town; -Saldanha

Bay. No shore leave permitted.

Land Borders:

Land borders to neighbouring countries are closed except for trade. Cross-border road freight to

Mozambique, Zimbabwe, Botswana, and The Democratic Republic of Congo are moving with

some delays due to capacity and at the borders. Slight delays for cross-border road freights.

(Agility, 13 July 2020)

All movement of goods within South Africa allowed. All movement of goods for Import and

Export allowed, except tobacco products. Cross border transportation of all goods allowed.

Source: https://vosocc.unocha.org....

Source: WCO/South Africa Revenue Authority

07.05.2020

1. Measures aiming to Facilitate the Cross-border Movement of Relief and

Essential Supplies

1.1. Essential/emergency goods are prioritised for facilitation across borders.

1.2. Member states (SACU) and neighbours have shared their list of essential

goods.

1.3. All movements are considered within the existing domestic lockdown

regulations. All ports of entry operating hours have been shared.

1.4. Risk measures in place to combat smuggling and abuse of rebate item

provisions.

2. Measures aiming at Supporting the Economy and Sustaining Supply Chain

Continuity

2.1. Lockdown phase 1 only allowed essential goods to move to end user.

Progressively the movement of all goods is allowed with non-essential goods being

allowed to be warehoused during lockdown period. Revised relaxed regulations

introduced in alignment the 5 different threat levels.

2.2. Cross border cargo movements allowed in conjunction with destination country

regulations including mode of transport.

2.3. Risk measures in place to combat smuggling and facilitation measures in place

to alleviate port congestion.

3. Measures aiming at Protecting Customs administrations’ Staff

3.1. Work from home policy also in place. Phased approach to front line capacity at

work based on demand. Work Exemption list in place (seniors above 60/pregnancy &

pre-existing health conditions).

3.2. Limited face to face interaction, social distancing. Clients make use of electronic

communication channels. Client meetings arranged by appointments only.

3.3. PPE’s (gloves, masks and sanitisers) issued to all staff. Hazmat suits, plastic face

masks, goggles and shoes covers also issued to high risk inspectorate. Perspex

Screen protectors rolled out to cover all open customs counters. Enviro-friendly

Biohazard bins and bags provided to all customs offices.

3.4. Office deep cleansing and fumigation plans activated. Social distancing managed

and monitored. Temperature testing readers in place. Wellness programmes including

call centres in place. Outreach and education programmes in place.

4. Measures aiming at Protecting Society

4.1. Limited external client meetings. Continuous communications. Limited

movements under strict controlled measures like permits. Limited gatherings to funeral

only (50). No religious gatherings, no cinemas/theatres, no social and public

gatherings. Social awareness programmes.

4.2. Testing stations made available, mobile testing units already activated. Additional

emergency beds and stations available.

4.3. Roadblocks and mobile enforcement units to ensure adherence to lockdown

regulations.

5. Other Measures.

5.1. Social grants and business rescue packages.

Further information: http://www.wcoomd.org/-/......ral-disaster/covid_19/south-africa_en.pdf?la=en