Source: World Tourism Organization UNWTO

Source: WCO/Customs administration (Superintendency of Tax Administration -SAT-) - Guatemala

06.04.2020

Customs administration (Superintendency of Tax Administration -SAT-) - Guatemala

Aware of the state of calamity that we are facing worldwide and abiding by the provisions determined by the Government of Guatemala, we inform the general public that the country's Customs maintains the development of its operations in a normal way, prioritizing the flow of goods necessary to face this crisis.

Actions:

- The Guatemala Government ordered the closure of borders for foreigners,

suspended commercial flights, allowing only the entry of cargo by maritime, land and air

customs.

- The Guatemala Government approved the exemption from Value Added Tax -IVAand Import Tariff Duties -DAI- to the National Coordinator for Disaster Reduction - CONRED-, Churches, organizations and charitable associations that import in order to bring critical goods for the emergency attention of COVID-19.

- The Institutional Crisis Management Committee was created, which is made up of the

higher authorities of the Customs Service (Superintendence of Tax Administration) and is in permanent session, which, according to the decisions of the Government of Guatemala, is taking institutional actions to effectively support them, including actions to protect internal staff and the form of institutional interaction with external users.

- There is an agile procedure for Relief shipments.

- A “Guidance Document for imports during the State of Calamity by COVID-19” was

prepared and published.

- Coordination of attention hours with the Temporary Customs Depositaries at

Seaports and Airports.

- Physical verification of the goods without the presence of the declarant.

- Attention to Customs brokers for continuity of international trade operations.

- Continuity of attention to files and requests for Auxiliaries of the customs public function.

- Institutional Protocol COVID-19, which includes training for personnel and protocols

for entrance of facilities, activities at work, use of institutional vehicles, return home after

work and to identify symptoms.

- As a security measure for the staff delegated to the different customs facilities in the country, each of the facilities has been supplied with masks and antibacterial gel, in addition to a series of recommendations and guidelines for maintaining sanitized spaces.

- The personnel of the Customs Service, following the decisions of the Government of Guatemala, were included within the public and private entities that have no mobility restriction, in order to carry out customs functions for the benefit of the country.

- The Customs service is part of the National Coordinator for Disaster Reduction - CONRED-, which allows us to have immediate information on the management of the crisis and to be clear on the procedure that must be applied to receive donations and humanitarian aid, at the different customs from the country.

- For the administrative areas, the initiative of the Government of Guatemala “Stay at Home” is being supported, promoting work from home and only an essential number of people is working in institutional offices.

- Work from home or vacation authorization for staff at risk: Pregnant or nursing women, mothers of children under 12 years of age, people with chronic conditions and people over 65 years of age.

- Support for essential personnel of SAT, who work in administrative offices, considering the curfew ordered by the Government of Guatemala, departure at 1:00 pm. and option of transportation from home to office.

- Management of institutional correspondence electronically and not physically.

- The official means of communication of the Customs Service was established, which emanates from the Superintendent and institutional communication channels (Web Portal, Yammer, SAT Guatemala on Facebook and @satgt on Twitter).

- All the staff of the Customs Service should check their institutional email, Yammer and WhatsApp work groups, in order to be informed of the provisions and instructions emanating from the SAT authorities.

- Regarding the work of the Public and Private Dialogue and Cooperation Table on Customs Issues, there is a permanent communication through the Working Group via WhatsApp, which was created prior to the current crisis.

- A call was made to the auxiliaries of the customs public function, assistants, logistics agents and other users related to the Customs Service to maintain or generate the optimal health security protocols for the development of their functions, so that we can guarantee the operation of the Customs Service without risking the integrity of all involved.

- The use of the different automated tools created by the Customs Service is being promoted with users.

- The Customs Service, being aware of the current situation in Guatemala and in order to ensure compliance with tax obligations, declares as non-working days March 24, 25, 26, 27, 30 and 31, 2020, and 1, 2, 3, 6, 7, 8, 13 and April 14, 2020, for the calculation of deadlines established in days in the tax legislation.

The links of the SAT page of the information related to the above are attached. https://portal.sat.gob.gt/portal/

https://portal.sat.gob.gt/portal/noticias/aduanas-y-cadenas-de-abastecimiento- continuan-en-accion/

https://portal.sat.gob.gt/portal/noticias/la-superintendencia-de-administracion-tributaria- hace-de-conocimiento-la-resolucion-de-superintendencia-numero-sat-dsi-280-2020/

Source: Presidency

Decree 12-2020, EMERGENCY LAW TO PROTECT GUATEMALANS FROM THE EFFECTS CAUSED BY THE CORONAVIRUS PANDEMIC COVID-19 1. Pursuant to article 16 of the Emergency Law, they are declared exempt from all import taxes and the Value Added, customs duties on all donations received in favor of the National Coordinator for Disaster Reduction -CONRED-, and the churches, organizations and charitable associations duly authorized and registered in the Registry of Legal Persons of the Ministry of the Interior , while the State of Public Calamity and its possible reforms are in force.

Decree No. 7-2020 extends for 30 days the “State of Public Calamity” declared by Government Decree No. 5-2020, of March 5, 2020.

--------------------------

Decreto 12- 2020, LEY DE EMERGENCIA PARA PROTEGER A LOS GUATEMALTECOS DE LOS EFECTOS CAUSADOS POR LA PANDEMIA CORONAVIRUS COVID-19 1. De conformidad al artículo 16 de la Ley de Emergencia, se declaran exentas de todos los impuestos de importación y del Impuesto al Valor Agregado, derechos arancelarios sobre todas las donaciones que se reciban a favor de la Coordinadora Nacional para la Reducción de Desastres -CONRED-, y las iglesias, organizaciones y asociaciones de beneficencia debidamente autorizadas e inscritas en el Registro de Personas Jurídicas del Ministerio de Gobernación, mientras esté vigente el Estado de Calamidad Pública y sus posibles reformas.

Decreto N° 7-2020 amplia por 30 días más el “Estado de Calamidad Pública” declarado mediante el Decreto Gubernativo N° 5-2020, de 5 de marzo del 2020.

Contact information:

Source: National Customs

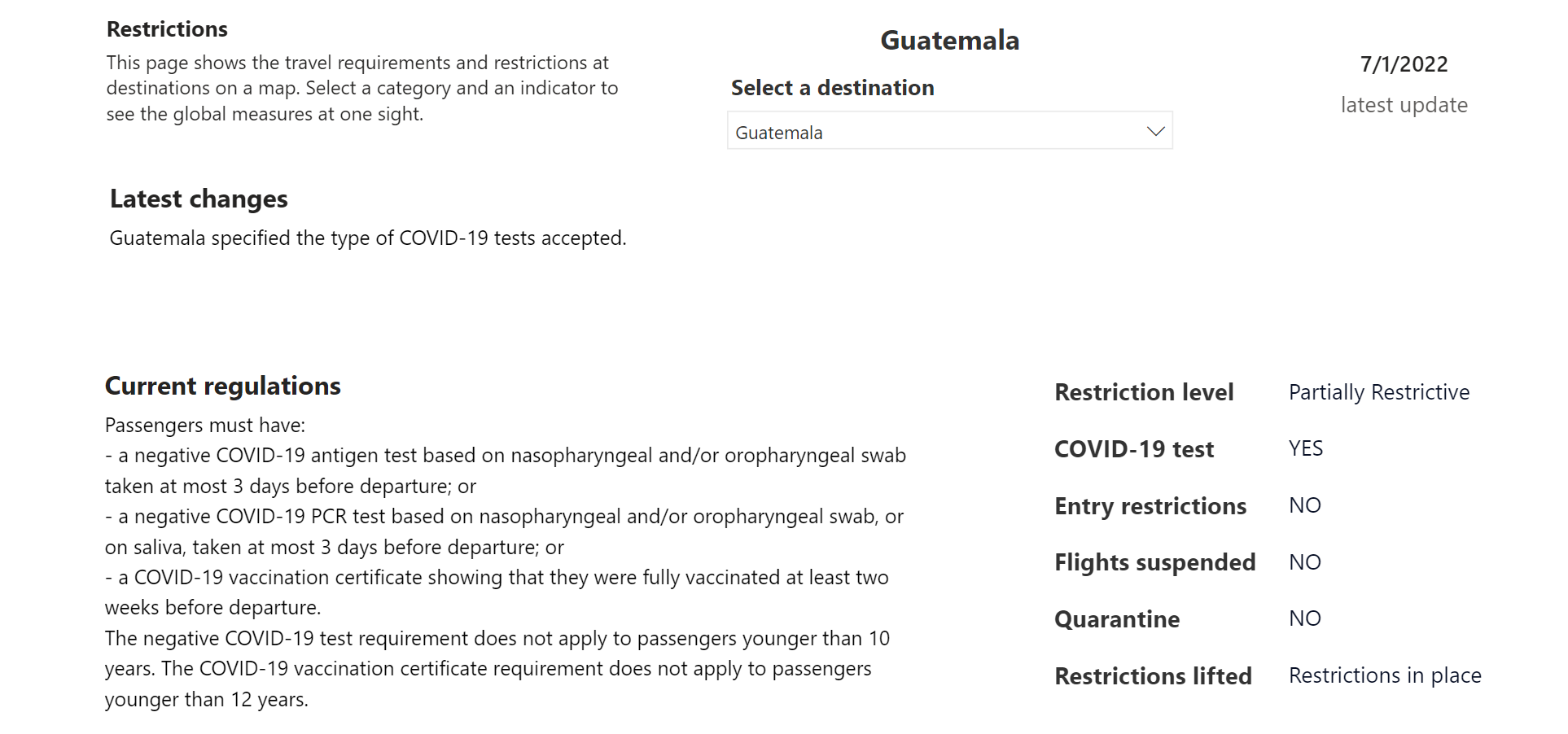

March 29, 2020: Closing of air, terrestrial and maritime bordersto travellers with certain specific exceptions for health and security. The following are excepted from the prohibition of entry or exit through the borders of the Republic:

-The transport of correspondence and air, sea and land cargo for import or export.

-Pilots and all transport crews must comply with the sanitary provisions issued by the Ministry of Public Health and Social Assistance to arrive in Guatemala, during their stay in the national territory and must immediately leave the cargo delivered or, if necessary, hold on to mandatory quarantine.

Customs service opening hours:

Tecún Umán I and El Carmen: 8:00 a.m. to 8:00 p.m., from Monday to Sunday

Tecún Umán II: 6:00 a.m. to 10:00 p.m., from Monday to Sunday

Pedro de Alvarado, Valle Nuevo, San Cristobal and La Ermita: 24 hours from Monday to Sunday

Corinth: 6:00 a.m. to 9:00 p.m., from Monday to Sunday

El Florido: 6:00 a.m. to 9:00 p.m., from Monday to Sunday

Agua Caliente: 6:00 to 21:00, from Monday to Sunday.

Guidance document for imports during the State of Calamity by COVID-19

------------------

March 29, 2020: Cierre de fronteras terrestres, aéreas y marítimas para todos los pasajeros no guatemaltecos (con ciertas excepciones específicas para la salud y la seguridad). Se exceptúa de la prohibición de ingreso o egreso por las fronteras de la República:

-El transporte de correspondencia y carga aérea, marítima y terrestre de importación o exportación.

-Los pilotos y toda la tripulación de los transportes deberán cumplir las disposiciones sanitarias emitidas por el Ministerio de Salud Pública y Asistencia Social para arribar a Guatemala, durante su estadía en el territorio nacional y deberán abandonar inmediatamente de entregada la carga o en su caso sujetarse a la cuarentena obligatoria.

Horario de atención en aduanas:

Tecún Umán I y El Carmen: 8:00 a 20:00 horas, de lunes a domingo

Tecún Umán II: 6:00 a 22:00 horas, de lunes a domingo

Pedro de Alvarado, Valle Nuevo, San Cristóbal y La Ermita: 24 horas de lunes a domingo

Corinto: 6:00 a 21:00, de lunes a domingo

El Florido: 6:00 a 21:00, de lunes a domingo

Agua Caliente: 6:00 a 21 horas, de lunes a domingo.

Documento de orientación para importaciones durante el Estado de Calamidad por el COVID19

More information: